Do I need an LLC for dropshipping?

Contents

-9dcb8.jpg)

Yes, you do need an LLC for your dropshipping business. When it comes to protecting your business and personal assets, you should always be on the safe side. We have outlined some tips for starting a dropshipping business and the exact time when you should get an LLC.

Business Structure

If you’re starting a dropshipping business, you need to decide on a business structure first. If you plan on collecting a good amount of profit from your business, it is advisable that you set up your business as a legal entity. There are different types of companies, but online retailers usually settle with one of the following three.

Sole Proprietorship

Sole proprietorship is the most basic business structure you can register as. However, know that the type doesn’t offer you any liability protection. In the event you get sued by a customer, you may come close to losing your personal assets.

On the other hand, the tax filing required for this is basic and you only need to report the earnings when you’re filing for personal tax.

Limited Liability Company (LLC)

LLC or Limited Liability Company is essentially the act of setting up your online store as a business entity that is separate from you. This ensures that in the event a customer decides to take you to court because of misunderstanding on the quality of the product or feels cheated by you in monetary ways, the court won’t be able to make you pay for compensation by using your personal assets.

We can’t call the LLC as foolproof, but it is better compared to sole propertiership in terms of protection. You will have to file tax returns separately for your company and pay ongoing fees. You will also have to pay a fee for establishing the company. As LLCs differ from state to state it’s good to check this guide on how to form an LLC on every state.

C Corporation

If you plan on getting into the dropshipping business with huge investment and expect a considerable amount of profit, you might want to look into C Corporation first. Many companies tend to choose this option, as it seems to offer the maximum liability protection.

The incorporation is more expensive than LLC and the tax filing is doubled.

If you have an average size business like most, LLC might be your best option. If you have enough fundings from the start to pay for the incorporation and ongoing fees, we recommend going for LLC from the start.

If that is not the case, start with sole propertiership and then eventually move on to LLC. How do you know when to opt for LLC though? Well, there are some factors you should take into consideration.

The Scale Of Your Business

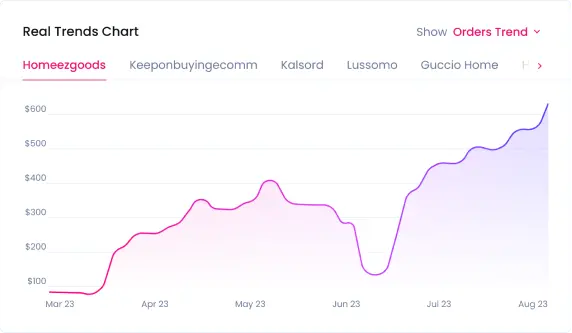

It’s not necessary to go for LLC if you’ve started a business recently and don’t even know whether it is going to be successful. However, if your store has been open for some time and you’ve been seeing a steady increase in customers perhaps due to some seo apps, you should consider it.

Good traffic isn’t enough to register for LLC though. Your business should have some level of success. A monthly profit margin that you can rely on so that even after you’ve filed for tax, paid your ongoing LLC fees, you still have some profit left for further investment and for your own personal needs.

You can have an excellent month and you decide to opt for LLC. Don’t be hasty. See if the streak continues for some months and the profit margin stays above the line.

The Time Of Establishment

If your business has only been around for a month or two, registering for LLC seems a bit hasty. This ties to the first point directly. Keep track of the progress in your business and see if your business continues to grow or at least continues at the same rate before getting an LLC.

Risk Assessment

What kind of products are you selling? Does your product come with a certain amount of risk? Say, you’re selling electronic products and a faulty one could lead to the customer getting hurt or even worst-case scenario, setting the house on fire.

In such a situation, your customer is quite likely to sue you. If you don’t win the case, you’re going to have to live with the nightmarish situation of having to turn your personal assets in if the damage is too big.

In the case of businesses with risky products, you shouldn’t delay in getting an LLC. The previous two points on whether your business is successful or even for a month old are unimportant. By relying on sole proprietorship in this case, you will be putting your house, car, jewelry, or any other personal asset you have on the line.

EIN Number

To start an online business, IRS has made it mandatory for all businesses to get an employer identification number. This is similar to a Social security number, it is only applicable to the legal company.

This is the number you will have to refer to when you are filing for taxes, applying to start your dropshipping account or opening a bank account in the name of your business.

In fact, anything related to your business has to be done through the EIN number to make sure all transactions and sales are attributed to the business.

Finances

This should be obvious but if you’re starting a dropshipping business, do not invest in it from your personal bank account or cash. It doesn’t matter whether you create a PayPal account, bank account or need a credit card, open all those accounts separately in the name of your business rather than yours. All transactions should be made from the business account.

Opening a dropshipping business isn’t as easy as people make it out to be, but sites like Shopify do offer some services to their customers such as automatic tax calculation that makes the process much easier. If you are looking to automate your entire business make sure to check out Sell The Trend, to get verified winning products and complete dropshipping store automation. Be sure to check out all the pros and cons of the business before you dip your toes in it.